Market Review September 2019

There was a good feeling sweeping through the equity markets in September as most of the major indices returned positive numbers. There were no spectacular rises – Japan and South Korea led the way as both markets gained 5% in the month, and a couple of markets barely moved at all, but the news was overwhelmingly positive.

The reason, as with so many things, may lie in the White House. President Trump delayed a planned $250bn (£203bn) tariff increase on Chinese goods as ‘a gesture of goodwill’ and China responded by scrapping some tariffs on US goods. The two sides are now due to hold fresh talks on resolving their long-running trade dispute, with the world economy – and stock markets – once more waiting with fingers crossed.

There was bad news for the world’s oil supplies in September, as a drone attack on two major facilities in Saudi Arabia reduced crude oil production by 5.7m barrels a day – roughly half their daily output.

UK

The UK equity market provided a positive return during September as the market rose moderately throughout the month.

The big story in the UK – Brexit aside – was the collapse of Thomas Cook. It had been on the cards for a long time and once the Government predictably refused the company’s request for a bailout the end was inevitable. There were estimated to be 150,000 people to bring home – and almost as many questions for Thomas Cook executives to answer over the bonuses they’d paid themselves as the company slid towards administration.

Despite the latest blow to the high street, there was some good news as Next announced a rise in profits and the nation’s pubs cashed in on the late summer heatwave.

Figures from the Office for National Statistics for July showed that the UK economy had grown by 0.3% in the month, helped by the dominant services sector. Average pay was up by nearly 4% compared to a year ago – the fastest increase in a decade – and unemployment was down to its lowest level for 45 years with 300,000 more people in work than a year previously.

This was good news for Chancellor Sajid Javid, who duly stated that the Government has “turned the page on austerity” and announced a raft of spending plans and infrastructure projects in his speech at the Conservative conference.

The FTSE 100 index which enjoyed a good month, rising by 3% to close September at 7,408. Helped by a ‘no-deal’ Brexit appearing less likely, the pound was up 1% in the month, closing at $1.2294.

Europe

European markets rallied strongly in September as investors adopted a more ‘risk on’ stance following some easing of US-China trade war rhetoric. The month also witnessed a sharp sector and style rotation as stocks with more cyclical characteristics (linked closely with economic activity) showed signs of coming back into favour, having significantly underperformed year to date.

Mario Draghi, leader of the European Central Bank, announced a fresh wave of stimulus measures to help shore up the economy with quantitative easing restarting from 1st November at a rate of €20bn (£17.8bn) every month.

The ECB said that the programme would run for “as long as necessary” while interest rates would continue “at their present or lower levels” until Eurozone inflation reached its target rate of 2%. ‘Lower levels’ might actually be something of an understatement, given that the ECB cut the deposit facility rate – the rate it pays to banks who have deposits with it – from minus 0.4% to minus 0.5%.

In keeping with most of the world stock markets, the two major European markets did well in September. The German DAX index rose 4% to 12,428 while the French stock market rose by a similar amount to end September very neatly at 5,678.

US

In the US, the Federal Reserve cut interest rates by a quarter of a percent. Despite the President’s desire to see yet more rate cuts, it seems unlikely that he will get his way, with the Fed making it very plain that they do not see rates falling below 1.5% to 1.75% any time before 2022.

The US economy added 130,000 jobs last month, slowing more than expected, the latest official figures have shown. Economists polled by Reuters had expected an increase of 158,000. The unemployment rate was unchanged at 3.7%, though, while average hourly earnings growth rose 3.2% from last year.

For now, though, Wall Street pronounced itself satisfied with the rate cut and the pause in the trade war hostilities, with the Dow Jones rising by 2% in the month to close September at 26,917.

Asia

The main headline, as seems to always be the case in the region, came from China as Chinese exports were down 1% in August compared with the same period a year ago as the trade war with the US continued to bite.

Make no mistake, China’s economy is still expanding at a rate that most economies can only dream about, but the pace of expansion is slowing significantly. The government is continuing to bring in measures to stimulate domestic demand, through both tax cuts and ‘introducing more liquidity into the financial system’ – or, as most people would say, making loans easier to get.

As far as the region’s stock markets were concerned, September was a good month. China’s Shanghai Composite index and the Hong Kong Hang Seng index were both up by 1% to 2,905 and 26,092 respectively. The Japanese and South Korean markets led the way in September as both rose by 5%.

Emerging Market

Emerging equity markets advanced higher in September with all the regions registering gains. Latin America was the best performer, followed by Asia. Renewed expectations of engagement between the US and China over their trade spat bolstered sentiment towards many of the export driven economies with strong demand for iPhone and 5G further boosting sentiment. Energy companies also advanced aided by a spike in oil prices following a drone attack at the world’s largest crude production site in Saudi Arabia.

While interest rate cuts in the eurozone and the US attracted global headlines, central banks in Latin America were also active with Brazil, Mexico and Chile reducing interest rates by 0.50%, 0.25% and 0.50% respectively. To bolster a sluggish economy and steer inflation back up towards the target, interest rates in Brazil were reduced to 5%, a record low.

In Asia, the Indian government was announcing its own stimulus package, as it surprisingly cut corporate tax rates from 30% to 22% in a bid to boost the economy and offset any slowdown caused by the US/China dispute and its impact on world trade. Unsurprisingly the move was welcomed by the Indian stock market, which rose 4% in the month to close September at 38,667. The Brazilian market was up by a similar amount to 104.

Summary

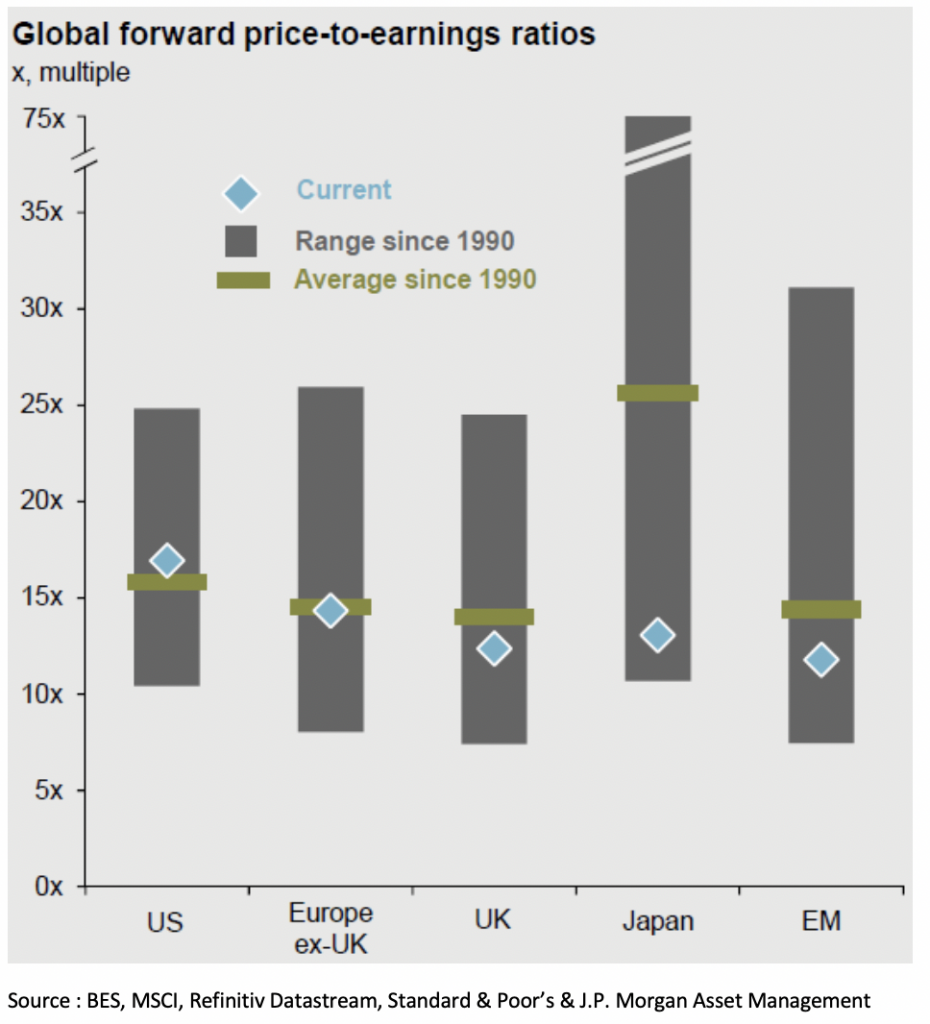

Despite concerns over negative figures for the global purchasing managers index for manufacturing and slowing global growth, underlying fundamentals remain robust with projected earnings justifying in most cases share price valuations below the long run global forward price to earnings ratios average since 1990. The only exception being the US which currently has a global forward price to earnings ratio just above the long run average.

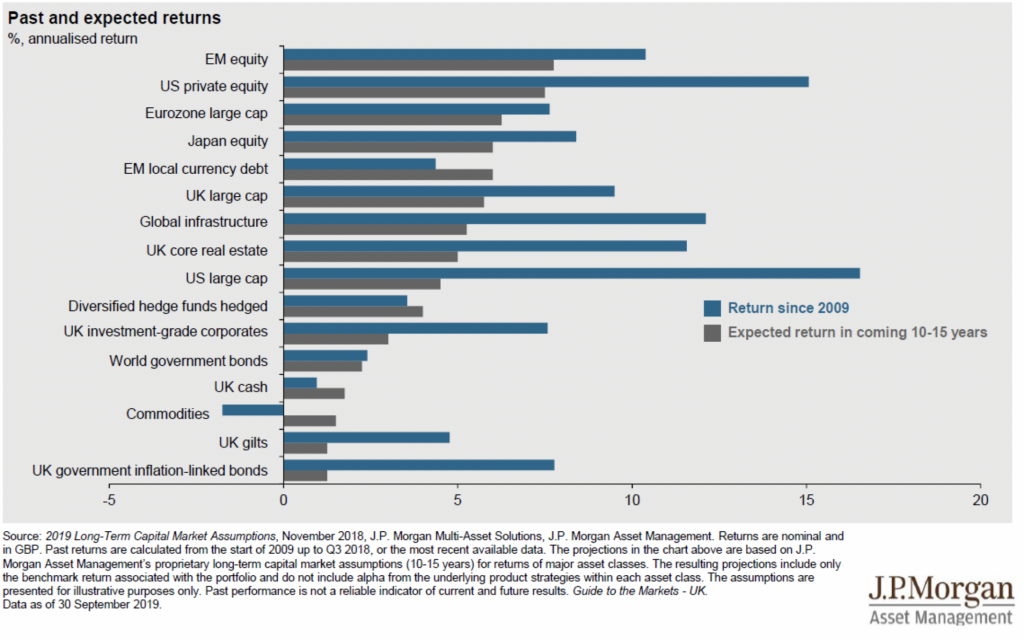

With forward looking price to earnings ratios tracking at or below long-term averages, current share prices look reasonable value having absorbed the current negative sentiment in the market. The chart below provides an overview of the annualised return for the past 10 years of various asset and sector classes and the JP Morgan projection of their expected annualised returns expected from various asset classes and sectors over the next 10-15 years.

As expected over the last 10 years, fixed interest investments have experienced a significant bull market with reducing inflation, quantitative easing and reducing interest rates helping increase bond capital prices over the period. However, during this period of low growth and possible interest rate increases in the future, fixed interest returns are likely to be muted, although good quality active fund managers should be expected to add value over the long term in an asset class that provides diversification from equities and the stock markets. At current valuation levels investment into equities globally over the long term looks appealing although as always there may be short term volatility linked to the current global slowdown and geopolitical risk. History has taught us that during periods of uncertainty and pessimism, this can sometimes be the best time to invest, however this can be unsettling and uncomfortable for investors over the short term.

At Vizion Wealth we have a firm belief that well-constructed diversified portfolios using a combination of good quality active fund managers with an element of passive investments, will offer significant value over the long term to all investors. Volatility and market pessimism typically offer excellent opportunities for fund managers to purchase assets at distressed prices which can prove rewarding when confidence returns to the market. Should you wish to talk through your portfolios or investment options, please do not hesitate to contact our advisers at any time.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.